How Stephen Gould Scaled Its Capacity by 30% without Making a Single Hire

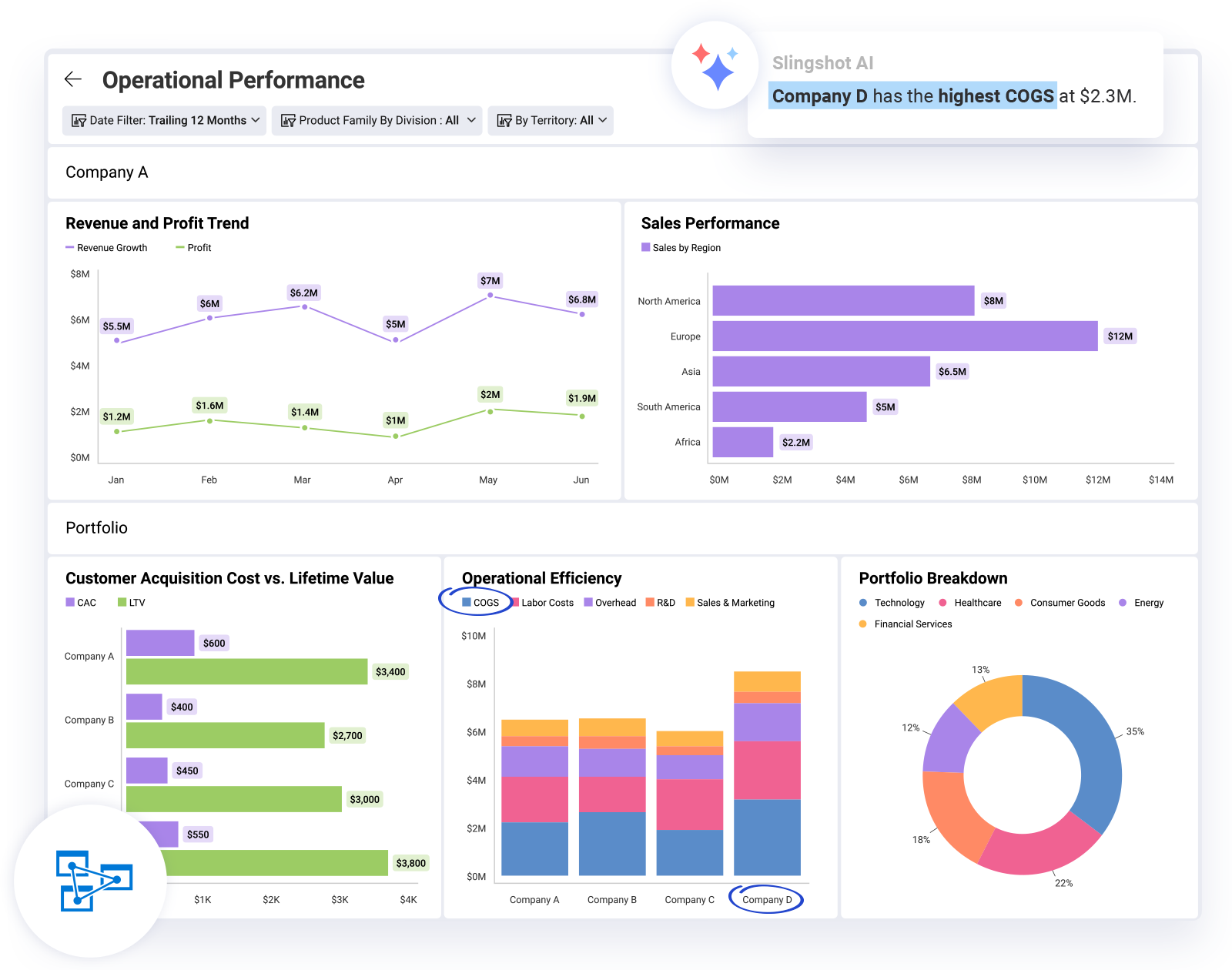

Connect actions to valuation with AI-driven analytics. Know where your companies score on the most important metrics in their industry. Have reports that map to best practices and your financial responsibilities. Based on real-time data for the highest probability of success.

Our expert team provides comprehensive implementation support and the training you need to drive growth through data and experimentation focused on key priorities to support your strategies.

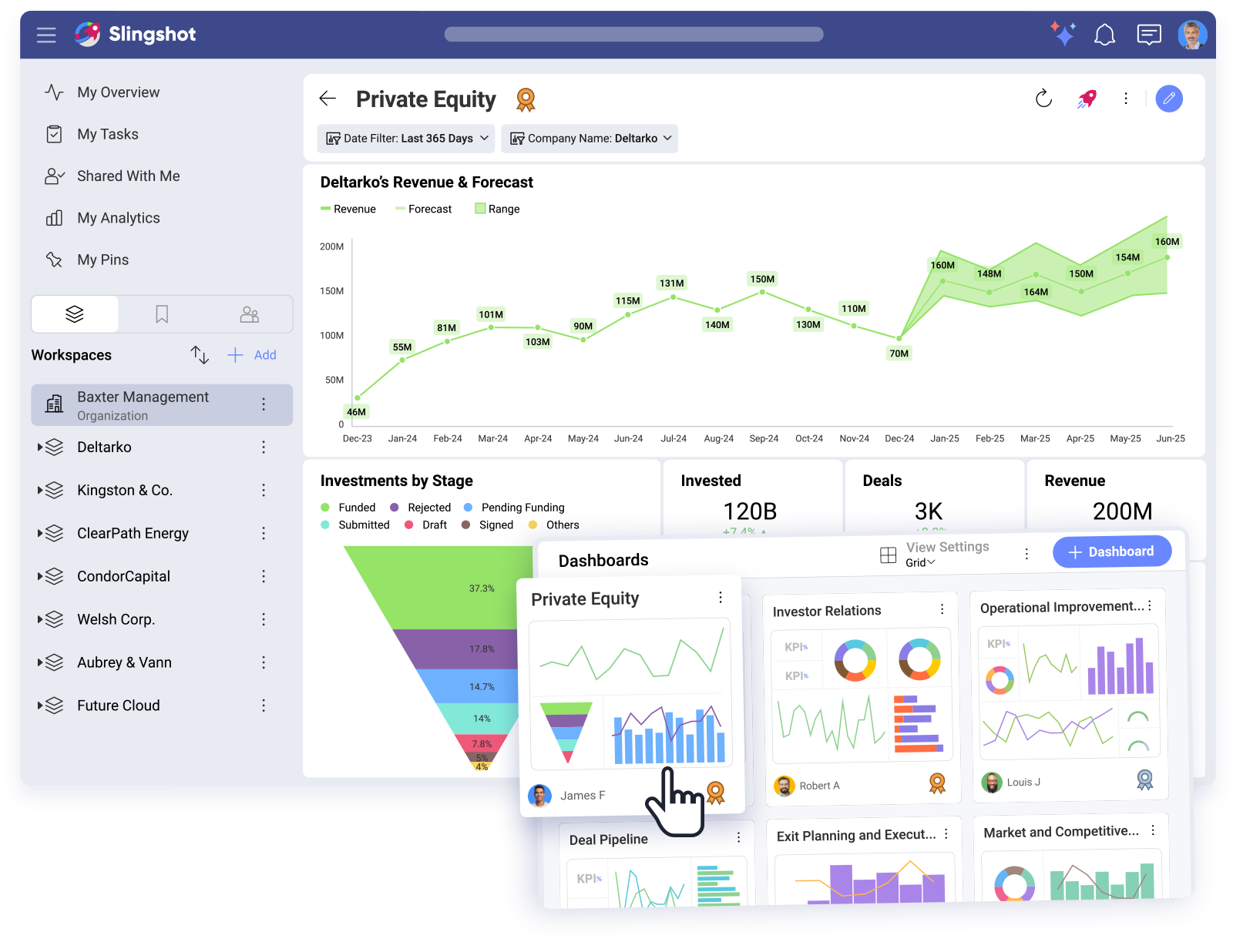

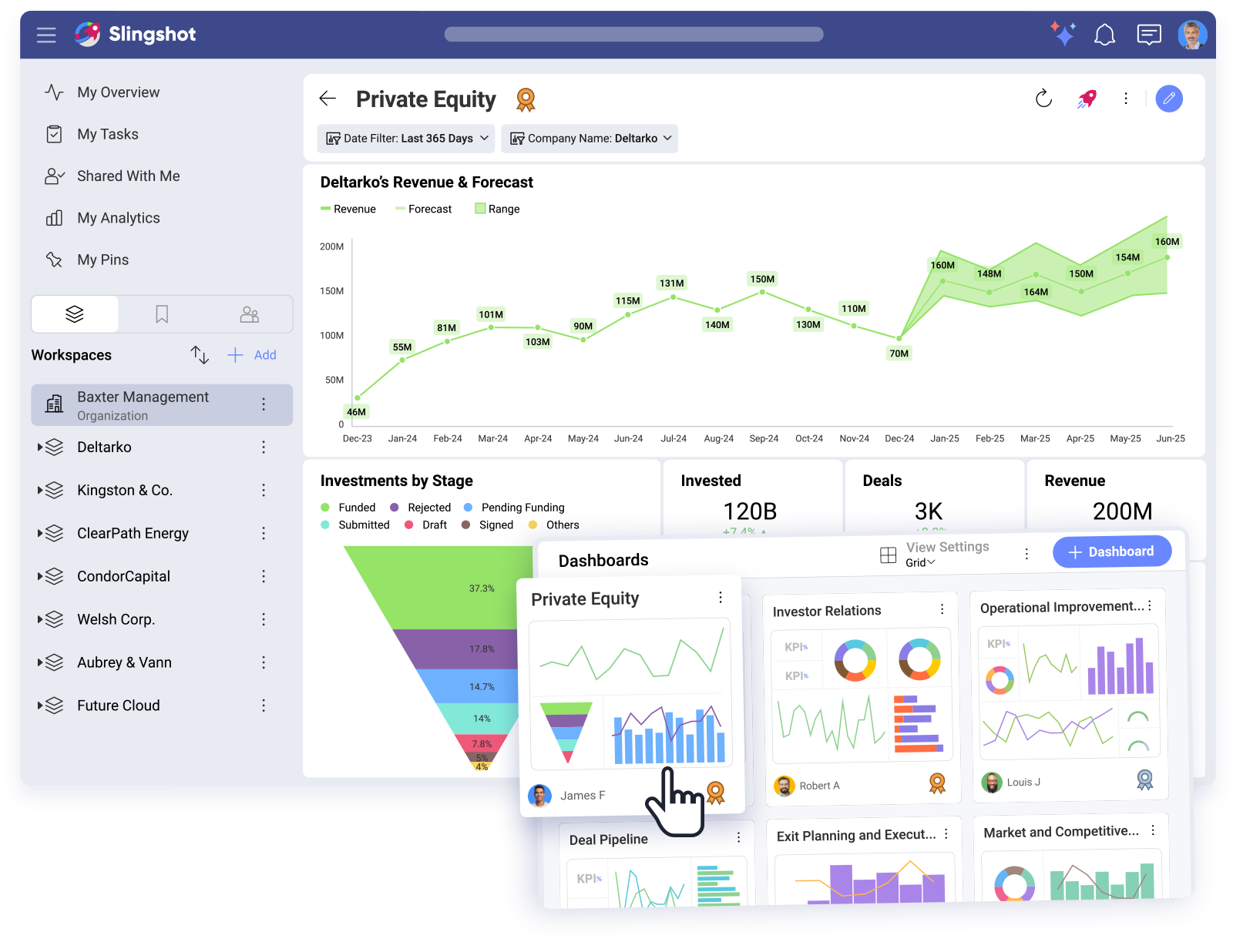

Slingshot helps Private Equity teams gain operational insights across portfolio companies. Our AI-powered work management platform creates one source of truth, making it easier to find growth opportunities, track key metrics, and enhance pre- and post-risk management and valuation processes through AI-powered analytics.

Slingshot helps Private Equity teams gain operational insights across portfolio companies. Our AI-powered work management platform creates one source of truth, making it easier to find growth opportunities, track key metrics, and enhance pre- and post-risk management and valuation processes through AI-powered analytics.

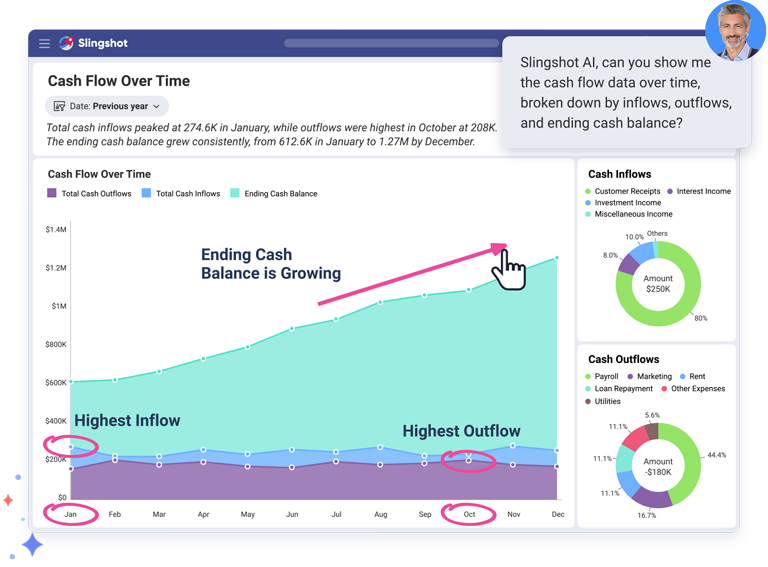

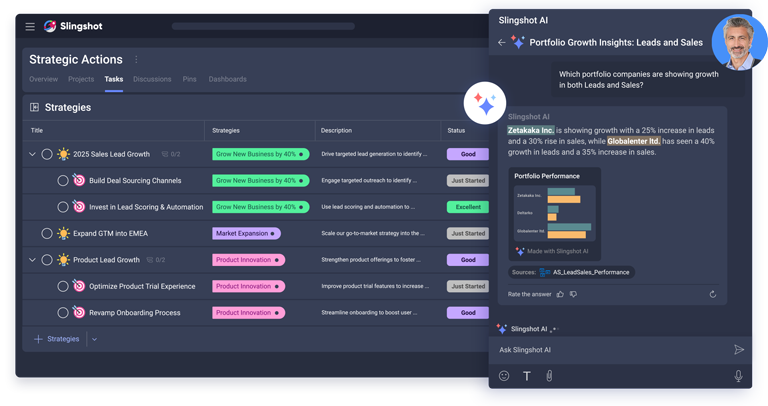

The Slingshot AI-powered work management platform helps Operating Teams connect strategy to measurable outcomes with real-time performance insights. Our AI analyzes your sales, marketing, and finance data sets, helping you maintain focus on strategic priorities and create data-driven experiments to solve go-to-market issues faster.

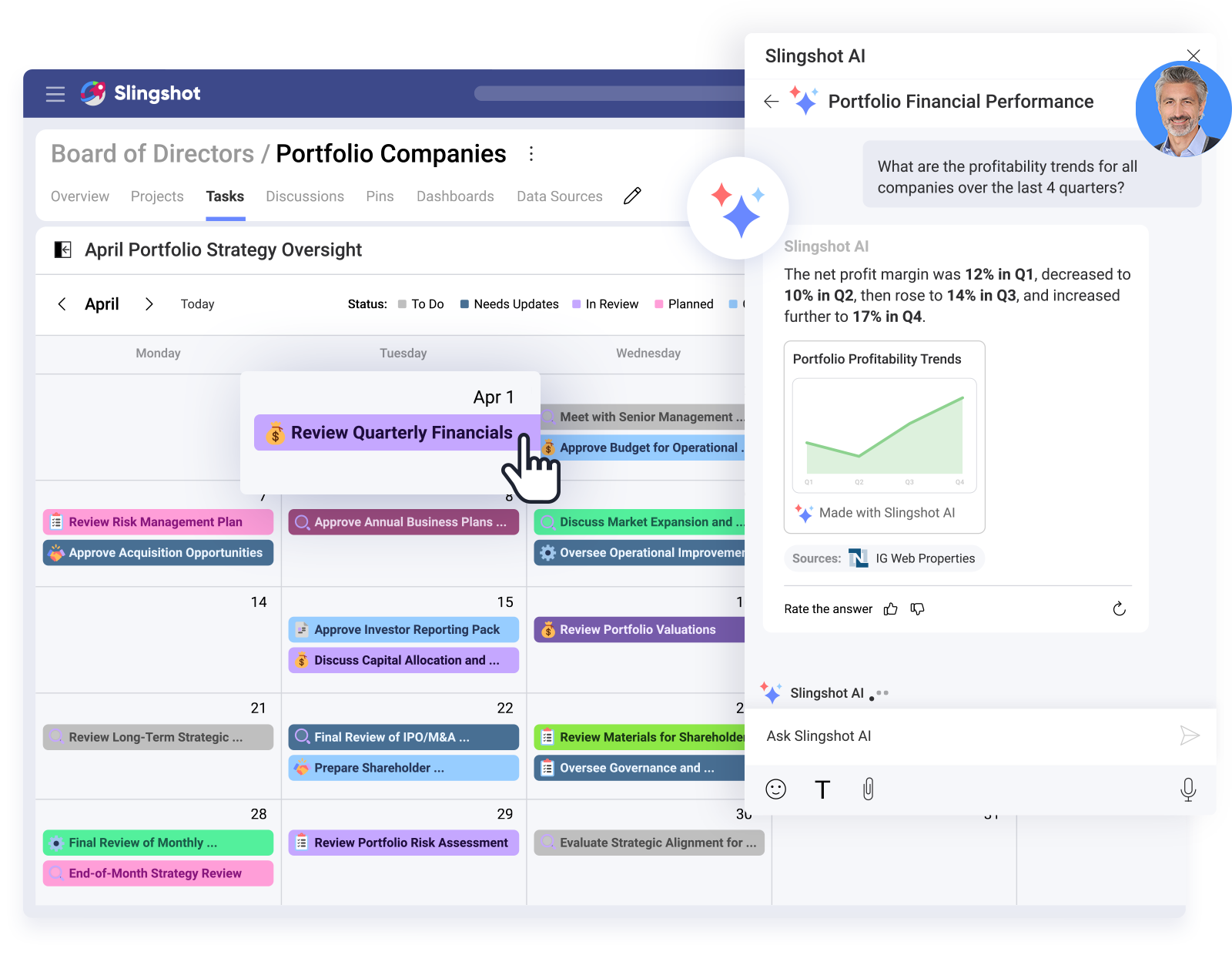

Slingshot shows Board Members how strategy links to the daily execution and resource allocation. Our AI-powered work management platform lets the board and executive team collaborate in one place. This allows for the quick and easy delivery of clear insights on key metrics and operational performance, keeping everyone on the same page.

Slingshot’s AI-powered work management platform ensures your strategy aligns with your daily execution. We give you one place to create real-time collaboration, manage tasks, oversee teams, and view key metrics so everyone knows the right priorities. Use practical tools that help you work smarter and improve margins.

Slingshot’s AI-powered work management platform enhances collaboration, streamlines project management, and fosters seamless teamwork by providing a centralized hub for aligning goals, tracking progress, and executing strategies efficiently.

Connect investors, entrepreneurs, and board members with intuitive dashboards that present complex data in a clear, actionable way.

Give raw data context through AI, in real-time to deliver fact-based growth strategies.

Keep teams in sync with real-time data source integration, allowing them to communicate objectives and address issues faster.

Combine planning, management, and tracking with customizable playbook templates all in one place to drive effective execution.

Our team handles the entire setup process, from data integration to AI training. Your data remains in your cloud, ensuring full ownership while leveraging Slingshot’s SOC2 and GDPR compliance.

Schedule a consultation with our team to see how Slingshot can drive growth across your portfolio. Let’s explore how we can tailor our solutions to drive your success story.