How Stephen Gould Scaled Its Capacity by 30% without Making a Single Hire

Data plays a crucial role in startup financing by helping entrepreneurs secure funding and investors make informed investment decisions that ultimately are a win-win situation for both parties.

Executive Summary:

Data plays a crucial role in startup financing by helping entrepreneurs secure funding and investors make informed investment decisions that ultimately are a win-win situation for both parties.

Starting and sustaining a startup company requires a lot more than a brilliant idea.

Having access to accurate and reliable data can make all the difference between success and failure.

And this is particularly true when it comes to financing your startup.

Data plays a crucial role in startup financing by helping entrepreneurs secure funding and investors make informed investment decisions that ultimately are a win-win situation for both parties.

In this blog, we’ll explore which are the most popular ways to finance a startup business and why data is so important in startup financing.

Startup financing refers to the various methods and sources of funding that a new or early-stage company may use to raise capital to support its operations and startup growth. The financing needs of a startup may include funding for product development, market research, hiring employees, and expanding its customer base.

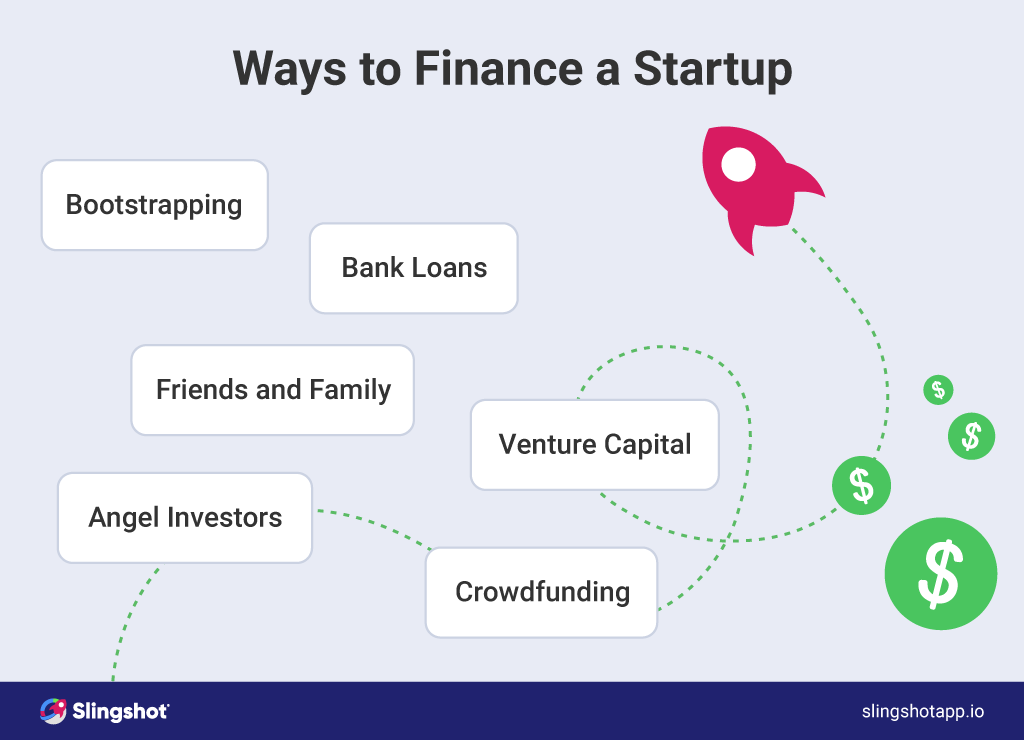

Financing can be one of the biggest startup challenges, but there are several options to make it happen. The primary ways to finance a startup include:

Each of these financing methods has its advantages and disadvantages, and the choice of financing method will depend on multiple various factors, including the needs and goals of your startup, as well as the stage of its development. It’s also crucial to have a solid business plan and financial projections to demonstrate your potential for success to potential investors or lenders. And that is also why data and business intelligence tools for startups are crucial when it comes down to financing.

Data is crucial in startup financing because it provides valuable insights into a company’s operations, financial health, and growth potential. Data analytics can provide startups with information that can help them secure financing. Investors need to make informed decisions about whether to invest in a startup, and data is a critical tool that helps them evaluate the company’s potential for success.

Some ways in which data is crucial in startup financing include:

In summary, data is crucial in startup financing because it helps investors understand a company’s growth potential, financial health, and risks, and make informed decisions about investing.

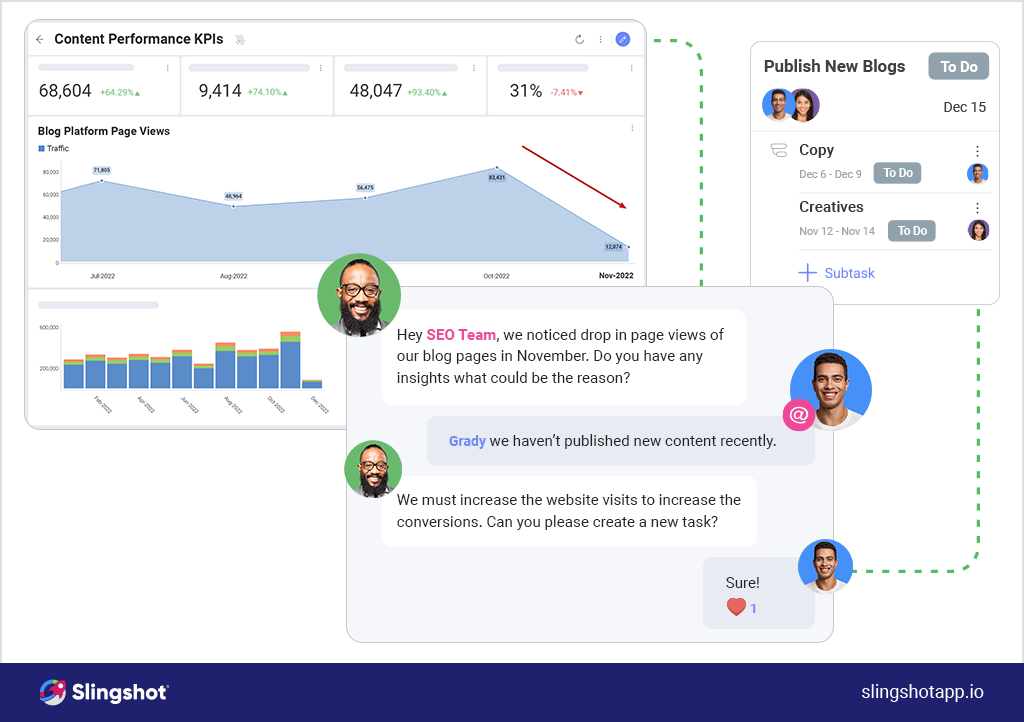

Whether you are at the seed stage, expansion stage, or growing into a small business, Slingshot can help you grow your start up fast and start hitting your revenue goals sooner. Run your startup effectively and profitability with a data-driven strategy, transparency, process overview, and alignment, to drive successful results and improve outcomes. We provide you with the speed, reliability, flexibility, connectivity, and security features to make it happen.

Slingshot helps you organize all your workflows, projects, tasks, content pieces, and more, all under the same roof. It also provides chat and discussions, so that you don’t have to switch between apps to view a message, a task, or a dashboard – you get all this together. Slingshot’s robust analytics features allow startups to connect to all their data to easily track KPIs and extract key insights. With Slingshot, you can go from data to task, from data to chat, and from chat to task with a single click.

See for yourself by trying Slingshot for startups today!

SHARE THIS POST